Abstract

Since 2011, Tunisia experienced a democratic transition, which upset the economic recovery. So, the main aim of this paper is to assess the sustainability of fiscal policy, considering Tunisia’s main macroeconomic variables. To this end, we applied two studies to analyze this policy over the period from 1970 to 2015. First, in the former study, sustainability was examined by a stationarity and cointegration econometric approach. Then the second study is based on an accounting approach in terms of threshold. The first study showed the non-sustainability of the public debt. This result was confirmed by the second approach. This study showed that the stimulus policy, “go and stop” undertaken by the transition government explains mostly the deterioration of the public debt and the deterioration of the main economic indicators.

Similar content being viewed by others

Notes

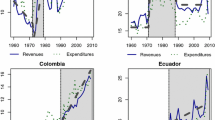

If there is a region having experienced several periods of financial crisis in the world, it is the Latin America region. But despite this, most of these countries in this area could improve their economic situation, as was the case of Argentina, Brazil, and Mexico.

The “Polity score,” captures this regime authority spectrum on a 21-point scale ranging from − 10 (hereditary monarchy) to + 10 (consolidated democracy). The Polity scores can also be converted into regime categories in a suggested three-part categorization of “autocracies” (− 10 to − 6), “anocracies” (− 5 to + 5 and three special values − 66, − 77, and − 88), and “democracies” (+ 6 to + 10).

The NPG constraint, also known in the literature as the transversality condition, states that the present value of government debt in the indefinite future converges to zero. The government cannot finance interest payments on debt by continuously issuing new debt.

The transition variable is coded according to the following scale:

[+ 3] Major democratic transition—6 points or greater increase in Polity score over a period of 3 years or less including a shift from an autocratic Polity value (− 10 to 0) to a partial democratic Polity value (+ 1 to + 6) or full democratic Polity value (+ 7 to + 10) or a shift from a partial democratic value to a full democratic value.

[+ 2] Minor democratic transition—3- to 5-point increase in Polity score over a period of 3 years or less including a shift from autocratic to partial democratic or from partial to full democratic value (see definitions above).

[+ 1] Positive regime change—3- or more-point increase in POLITY score without a shift in regime type as defined above.

[0] Little or no change in Polity score.

To improve our figure, we rescale regtrans which will take values from 0 to 4.

“Budgetary deficit” is a dummy variable which represents the threshold. Based on our calculation in Table 4, it takes 0 for negative values and 1 otherwise

Abbreviations

- MSEA:

-

Modeling and statistical and economic analysis

References

Ahmed, S., & Rogers, J. H. (1995). Government budget deficits and trade deficits are present value constraints satisfied in long-term data? Journal of Monetary Economics, 36(2), 351–374.

Belguith, S. O., & Gabsi, F. B. (2017). Public Debt Sustainability in Tunisia: Empirical Evidence Estimating Time-Varying Parameters. Journal of the Knowledge Economy, 1–11.

Bittencourt, M. (2015). Determinants of government and external debt: Evidence from the young democracies of South America. Emerging Markets Finance and Trade, 51(3), 463–472.

Bohn, H. (1998). The behavior of US public debt and deficits. Quarterly Journal of Economics, 113(3), 949–963.

Brooks, C. (2008). RATS Handbook to accompany introductory econometrics for finance. London: Cambridge Books.

Cammett, M. (2018). A political economy of the Middle East. UK: Hachette.

Chihi, F., & Normandin, M. (2013). External and budget deficits in some developing countries. Journal of International Money and Finance, 32, 77–98.

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, Econometric Society, 49(4), 1057–1072.

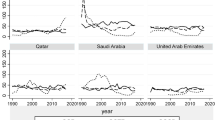

Diwan, I., & Akin, T. (2015). Fifty years of fiscal policy in the Arab region. Working Paper 914, The Economic Research Forum (ERF), 21 Al-Sad Al-Aaly Street Dokki, Giza Egypt.

Engle, R. F., & Yoo, B. S. (1987). Forecasting and testing in co-integrated systems. Journal of Econometrics, 35(1), 143–159.

Engle, R. F., & Granger, C. W. (1987). Co-integration and error correction: representation, estimation, and testing. Econometrica: Journal of the Econometric Society, 55(2), 251–276.

Ehrhart, C., & Llorca, M. (2008). The sustainability of fiscal policy: Evidence from a panel of six South-Mediterranean countries. Applied Economics Letters, 15(10), 797–803.

Filc, G., & Scartascini, C. (2007). Budgetary institutions. The State of State Reforms in Latin America, 157–84

Hakkio, C. S., & Rush, M. (1991). Is the budget deficit “too large?”. Economic Inquiry, 29(3), 429–445.

Hamilton, J. D., & Flavin, M. A. (2001). On the limitations of government borrowing: A framework for empirical testing. Equilibrium, 76(4).

Haug, A. A. (1995). Has federal budget deficit policy changed in recent years? Economic Inquiry, 33(1), 104–118.

Hénin, P. Y. (1997). Soutenabilité des déficits et ajustements budgétaires. Revue économique, 371–395.

Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica, 59, 1551–1580.

Milesi-Ferretti, G. M., Perotti, R., & Rostagno, M. (2002). Electoral systems and public spending. Quarterly Journal of Economics, 117(2), 609–657.

Neaime, S. (2010). Sustainability of MENA public debt and the macroeconomic implications of the recent global financial crisis. Middle East Development Journal, 2(02), 177–201.

Neaime, S. (2015). Sustainability of budget deficits and public debts in selected European Union countries. Journal of Economic Asymmetries, 12(1), 1–21.

Pastén, R., & Cover, J. P. (2010). The political economy of unsustainable fiscal deficits. Cuadernos de economía: Latin American Journal of Economics, (136), 169–189.

Persson, T., & Tabellini, G. (2006). Electoral systems and economic policy. Oxford Handbook of Political Economy

Persson, T., Roland, G., & Tabellini, G. (2007). Electoral rules and government spending in parliamentary democracies. Quarterly Journal of Political Science, 2(2), 155–188.

Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2) 335–346. https://doi.org/10.1093/biomet/75.2.335.

Quintos, C. E. (1995). Sustainability of the deficit process with structural shifts. Journal of Business & Economic Statistics, 13(4), 409–417.

Sachs, J. D., Fischer, S., & Obstfeld, M. (1985). The dollar and the policy mix: 1985. Brookings Papers on Economic Activity, 1985(1), 117–197.

Tanner, E., & Liu, P. (1994). Is the budget deficit “too large”? Some further evidence. Economic Inquiry, 32(3), 511–518.

Trehan, B., & Walsh, C. E. (1988). Common trends, the government’s budget constraint, and revenue smoothing. Journal of Economic Dynamics and Control, 12(2–3), 425–444.

Wilcox, D. W. (1989). The sustainability of government deficits: implications of the present-value borrowing constraint. Journal of Money, credit and Banking, 21(3), 291–306.

Williams, K. (2017). Does democracy dampen the effect of finance on economic growth?. Empirical Economics, 52(2) 635–658.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Gouasmi, Z., Haffoudhi, H. Analysis of Sustainability of Fiscal Policy and Democratic Transition: Case of Tunisia. J Knowl Econ 11, 512–529 (2020). https://doi.org/10.1007/s13132-018-0558-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-018-0558-5