Abstract

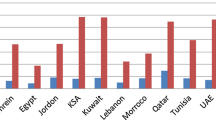

This paper examines the effectiveness of market discipline in motivating banks to mitigate their default risk by using capital buffers against adverse effects in portfolio risk. Using a large sample of 126 banks from 9 MENA countries from 2009 to 2014, we study whether support, funding, and risk disclosure motivate banks to hold larger capital buffers to cover potential portfolio risk or not; and whether it affects differently Islamic and conventional banking sectors. Our paper findings provide evidence of the contradictory effects of these factors on Islamic banks compared to conventional banks. While government support results in higher capital buffers, stronger market discipline resulting from uninsured liabilities and disclosure results in larger capital buffers. Most factors look effective only for the conventional banking industry and ineffective for the Islamic banking industry due to its risk-sharing characteristic. Our paper findings provide evidence of the effectiveness of market discipline mechanisms, especially for the conventional banking industry. Moreover, high government support reinforces the disclosure and uninsured funding effects, especially for conventional banks. Finally, competition minimizes bank’s risk incentives.

Similar content being viewed by others

Notes

The BankScope database provided information for the years 2009–2014.

References

Abdallah, A.A.-N., Hassan, M. K., & McClelland, P. L. (2015). Islamic financial institutions, corporate governance, and corporate risk disclosure in Gulf Cooperation Council countries. Journal of Multinational Financial Management, 31, 63–82.

Alaeddin, O., Archer, S., Karim, R. A. A., Rasid, M., & Shah, M. E. (2017). Do profit-sharing investment account holders provide market discipline in an islamic banking system? Journal of Financial Regulation, 3(2), 210–232.

Alfon, I., Argimón, I., & Bascuñana-Ambrós, P. (2004). What determines how much capital is held by UK banks and building societies?

Aysan, A. F., Disli, M., Duygun, M., & Ozturk, H. (2017). Islamic banks, deposit insurance reform, and market discipline: Evidence from a natural framework. Journal of Financial Services Research, 51(2), 257–282.

Aysan, A. F., Disli, M., Ng, A., & Ozturk, H. (2016). Is small the new big? Islamic banking for SMEs in Turkey. Economic Modelling, 54, 187–194.

Aysan, A. F., Disli, M., Ozturk, H., & Turhan, I. M. (2015). Are Islamic banks subject to depositor discipline? The Singapore Economic Review, 60(01), 1550007.

Ayuso, J., Pérez, D., & Saurina, J. (2004). Are capital buffers pro-cyclical?: Evidence from Spanish panel data. Journal of Financial Intermediation, 13(2), 249–264.

Barakat, A., & Hussainey, K. (2013). Bank governance, regulation, supervision, and risk reporting: Evidence from operational risk disclosures in European banks. International Review of Financial Analysis, 30, 254–273.

Barth, J. R., Levine, R., & Caprio, G. (2013). Bank regulation and supervision in 180 countries from 1999 to 2011. Journal of Financial Economic Policy, 5(2), 111–219.

Berger, A. (1995). The Relationship between Capital and Earnings in Banking. Journal of Money, Credit and Banking, 27(2), 432–456.

Berger, A., & Turk-Ariss, R. (2015). Do Depositors Discipline Banks and Did Government Actions During the Recent Crisis Reduce this Discipline? An International Perspective. Journal of Financial Services Research, 48(2), 103–126.

Berger, A. N. (1991). Market discipline in banking (Proceedings No. 328). Federal Reserve Bank of Chicago. Retrieved from https://econpapers.repec.org/paper/fipfedhpr/328.htm

Billett, M. T., Garfinkel, J. A., & O’Neal, E. S. (1998). The cost of market versus regulatory discipline in banking. Journal of Financial Economics, 48(3), 333–358.

Blum, J. M. (2002). Subordinated debt, market discipline, and banks’ risk taking. Journal of Banking & Finance, 26(7), 1427–1441.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Cabedo, J. D., & Tirado, J. M. (2004). The disclosure of risk in financial statements. Accounting Forum, 28(2), 181–200.

Calomiris, C., & Wilson, B. (2004). Bank capital and portfolio management: The 1930s “capital crunch” and the scramble to shed risk. The Journal of Business, 77(3), 421–456.

Cordella, T., & Levy Yeyati, E. (1998). Public disclosure and bank failures. IMF Staff Papers, 45(1), 110–131.

Cutura, J. A. (2021). Debt holder monitoring and implicit guarantees: did the BRRD improve market discipline? Journal of Financial Stability, 54, 100879.

Demirgüç-Kunt, A., & Sobaci, T. (2001). A new development database. Deposit insurance around the world. The World Bank Economic Review, 15(3), 481–490.

Demirgüç-Kunt, A., & Detragiache, E. (2002). Does deposit insurance increase banking system stability? An empirical investigation. Journal of Monetary Economics, 49(7), 1373–1406.

Demirgüç-Kunt, A., Karacaovali, B., & Laeven, L. (2005). Deposit Insurance Around the World: A Comprehensive Database (SSRN Scholarly Paper No. ID 756851). Rochester, NY. Retrieved from https://papers.ssrn.com/abstract=756851

Eisenbach, T. M. (2017). Rollover risk as market discipline: A two-sided inefficiency. Journal of Financial Economics, 126(2), 252–269.

Farooq, M., & Zaheer, S. (2015). Are Islamic banks more resilient during financial panics? Pacific Economic Review, 20(1), 101–124.

Flannery, M. J., & Rangan, K. P. (2006). Partial adjustment toward target capital structures. Journal of Financial Economics, 79(3), 469–506.

Freixas, X. (1999). Optimal bail out policy, conditionality and constructive ambiguity. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.199054

Ghosh, S. (2017). Capital buffers in Middle East and North Africa (MENA) banks: Is market discipline important? International Journal of Islamic and Middle Eastern Finance and Management, 10(2), 208–228.

Godspower-Akpomiemie, E., & Ojah, K. (2021). Market discipline, regulation and banking effectiveness: Do measures matter? Journal of Banking & Finance, 133, 106249.

Goldberg, L. G., & Hudgins, S. C. (2002). Depositor discipline and changing strategies for regulating thrift institutions. Journal of Financial Economics, 63(2), 263–274.

Gropp, R., & Vesala, J. (2004). Deposit Insurance, Moral Hazard and Market Monitoring. Review of Finance, 8(4), 571–602.

Haq, M., Avkiran, N. K., & Tarazi, A. (2019). Does market discipline impact bank charter value? The case for Australia and Canada. Accounting & Finance, 59(1), 253–276.

Hasan, I., Jackowicz, K., Kowalewski, O., & Kozłowski, Ł. (2013). Market discipline during crisis: Evidence from bank depositors in transition countries. Journal of Banking & Finance, 37(12), 5436–5451.

Hett, F., & Schmidt, A. (2017). Bank rescues and bailout expectations: The erosion of market discipline during the financial crisis. Journal of Financial Economics, 126(3), 635–651.

Hovakimian, A., Kane, E. J., & Laeven, L. (2003). How country and safety-net characteristics affect bank risk-shifting. Journal of Financial Services Research, 23(3), 177–204.

Jagtiani, J., & Lemieux, C. (2001). Market discipline prior to bank failure. Journal of Economics and Business, 53(2–3), 313–324.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jordan, J. S. (2000). Depositor discipline at failing banks. New England Economic Review, 15–28.

Keeley, M. C. (1990). Deposit insurance, risk, and market power in banking. The American Economic Review, 1183–1200.

Krippendorff, K. (1980). Validity in Content Analysis. Computerstrategien Für Die Kommunikationsanalyse, 69–112.

Krippendorff, K. (2004). Reliability in content analysis. Human Communication Research, 30(3), 411–433.

Lindquist, K.-G. (2004). Banks’ buffer capital: How important is risk. Journal of International Money and Finance, 23(3), 493–513.

Linsley, P. M., & Shrives, P. J. (2006). Risk reporting: A study of risk disclosures in the annual reports of UK companies. British Accounting Review, 38, 387–404.

Maechler, A. M., & McDill, K. M. (2006). Dynamic depositor discipline in US banks. Journal of Banking & Finance, 30(7), 1871–1898.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221.

Nier, E., & Baumann, U. (2006). Market discipline, disclosure and moral hazard in banking. Journal of Financial Intermediation, 15(3), 332–361.

Oliveira, J., Lima Rodrigues, L., & Craig, R. (2011). Voluntary risk reporting to enhance institutional and organizational legitimacy: Evidence from Portuguese banks. Journal of Financial Regulation and Compliance, 19(3), 271–289.

Omet, G., Saif, I., & Yaseen, H. (2008). Market discipline and deposit insurance: evidence from some Middle Eastern banks. Corporate Ownership and Control. https://doi.org/10.22495/cocv6i1c2p4

Porta, R. L., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1998). Law and finance. Journal of Political Economy, 106(6), 1113–1155.

Rochet, J. (1992). Capital requirements and the behaviour of commercial banks. European Economic Review, 36(5), 1137–1170.

Shimizu, K. (2009). Is the information produced in the stock market useful for depositors? Finance Research Letters, 6(1), 34–39.

Shrieves, R., & Dahl, D. (1992). The relationship between risk and capital in commercial banks. Journal of Banking & Finance, 16(2), 439–457.

Song, M. I., & Oosthuizen, C. (2014). Islamic banking regulation and supervision: Survey results and challenges. International Monetary Fund.

Tran, D. V., Hassan, M. K., & Houston, R. (2019). How does listing status affect bank risk? The effects of crisis, market discipline and regulatory pressure on listed and unlisted BHCs. The North American Journal of Economics and Finance, 49, 85–103.

Trinugroho, I., Pamungkas, P., Ariefianto, M. D., & Tarazi, A. (2020). Deposit structure, market discipline, and ownership type: Evidence from Indonesia. Economic Systems, 44(2), 100758.

Funding

The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Grassa, R., Moumen, N., Kabir Hassan, M. et al. Market discipline and capital buffers in Islamic and conventional banks in the MENA region. Eurasian Econ Rev 12, 139–167 (2022). https://doi.org/10.1007/s40822-021-00195-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-021-00195-0

Keywords

- Risk disclosure

- Market discipline

- Moral hazard

- Competition

- Islamic banks

- Financial institutions

- MENA region