Abstract

In the early stages of growth of a city, housing market fundamentals are uncertain. This could attract speculative investors as well as actual housing demand. Sejong is a recently built administrative city in South Korea. Most government departments and public agencies have moved into it, while others are in the process of moving or plan to do so. In Sejong, a drastic escalation in house prices has been noted over the last few years, but at the same time, the number of vacant housing units has increased. Using the present value model, lease-price ratio, and log-periodic power law, this study examines the bubbles in the Sejong housing market. The analysis results indicate that (i) there are significant house price bubbles, (ii) the bubbles are driven by speculative investment, and (iii) the bubbles are likely to burst earlier here than in other cities. The approach in this study can be applied to identifying pricing bubbles in other cities.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

In newly developed cities, housing market fundamentals are difficult to predict. Many factors affecting the housing market, such as economic conditions, educational environment, and infrastructure, are largely uncertain. Sejong is a newly built city in South Korea, whose purpose is to function as an administrative center, similar to Washington DC in the USA. The legislative plan for the city was enacted in 2003, and government departments and public agencies started to move into it in 2012. As of 2017, the main ministry offices had completed their relocation. The key purposes of building a new administrative city were: (i) to diversify the role of a heavily laden Seoul, which worked as both an administrative capital and financial center; and (ii) to boost the local economy of Sejong and the surrounding area.

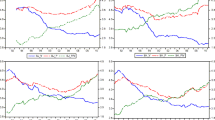

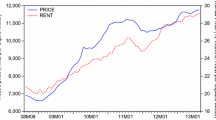

Sejong has recently experienced a sharp rise in house (condominiumFootnote 1) prices (Fig. 1(a)). Indeed, condominium prices have increased persistently over the last few years in a national wide. Sejong has experienced a similar trend, although its price increase began later than both that of Seoul and the country as a whole. The government implemented special regulations to prevent the overheat of housing market in Sejong, but the house prices continued to rise. On the other hands, the vacancy rate indicates that in comparison with other major cities, something unusual is happening in Sejong. The vacancy rate in the Sejong housing market hit 20% in 2015, while other major cities experienced on average only that of 5.2% rate (Fig. 1(b)). This exceptional price appreciation appears that it has not been driven by housing demand while implying potential bubbles in Sejong.

Real estate prices in new cities have not been well studied in the recent literature [10, 11, 20, 23, 31]. Existing studies have focused on employment changes or the structure of a new city, rather than focusing on the housing market as their major concern. In order to bridge this gap, this paper aims to empirically evaluate the economic impacts on a new administrative city, Sejong, in terms of a real estate bubble.

First, to identify the aforementioned a real estate bubble we employed the present value model: in this calculation, the housing prices and rents with the discount rate are used. In the literatures, various approaches have been applied to detect real estate bubbles. Many of them have tried to establish the fundamental value of house price, which can be considered as the equilibrium price of supply and demand. Bourassa et al. [3] argued that house prices at 20% above their fundamental values can be seen as a sign of bubbles. Abraham [1], and Hendershott and Roche [27] constructed the statistical models to estimate fundamental market values. In both studies, the statistically significant difference between fundamental values and actual house prices was interpreted as a sign of bubbles. Conversely, Meese and Wallace [24] used the present value model and analyzed the bubble using house prices and rents, while Mikhed and Zemčík [25] used fundamental variables including real house rent, mortgage rate, personal income, building cost, stock market wealth, and population. Having with an evidence from their univariate unit root and cointegration tests, they concluded that there had been a house price bubble in the USA prior to 2006. Using data on 20 districts in Paris from 1984 to 1993, another study found that a house price bubble had spread from wealthy districts, moving to medium-priced districts, until finally reaching low-priced districts [28]. As mentioned above, in the current study we adopted the present value model which reflects true house prices and rents, in accordance with both Campbell and Shiller [5] and Wang [32].

Next, in order to analyze the cause of the real estate bubble, we employed the lease-price ratio. Lind [22] categorized house price bubbles into three categories: pure speculative bubble, irrational expectations bubble, and irrational institutions bubble. Of these, we focused on the speculative bubble in this paper.

Finally, the Log-Periodic Power Law (LPPL) was adopted to estimate the critical time of the bubble. LPPL was first developed in statistical physics, subsequently gaining a wider attention because of its successful predictions [7, 13, 14]. In real estate research, LPPL was applied to examine the USA and UK real estate markets which exhibited an ultimately unsustainable speculative bubble [34, 35].

In summary, three approaches are applied in this research: the present value model for detecting housing bubbles, the lease-price ratio for identifying the cause of bubble and finally, the LPPL for estimating the critical time of the bubble burst.

2 Methods and Data

2.1 Methods

Present Value Model. To link the present value of an asset to its future income stream, in the way of cointegration, both Campbell and Shiller [5], and Wang [32] provided a model for testing expectations and rationality in financial markets. The present value of an asset is defined by

where \(Y_t\) is the present value of an asset as represented by the real estate price; \(y_t\) is the income as represented by rent derived from owning a real estate during the time period \((t-1,t)\); \(E_t\) is the expectations operator; and r is the discount rate. According to the present value model, if both the real estate price and rent have a unit root, they are cointegrated. This can be identified by a linear relationship. We define a new variable, called spread, as follows:

It can be seen that \(\theta \) is \(1\over r\) for the dividend type of income stream. Subtracting \(\theta y_t\) from both sides of (1) yields

From (2), if \(y_t\) has a unit root and \(\varDelta y_t\) is stationary, \(S_t\) will be stationary as well. This means that \(Y_t\) and \(y_t\) have a cointegrating relation. More than that, the effect of a “rational bubble"alternative is easily observed from (2). Let this bubble term \(b_t\) satisfy

where \(b_t\) is a rational bubble, and thus induces explosive behavior of \(S_t\) and \(\varDelta Y_t\) through (2). If there is a bubble, it can be noted that

If \(b_t\) is added to the right-hand side of (1) as (3), it appears on the right-hand side of (2). Therefore, a test for the existence of a bubble is equivalent to that for cointegrating relationship between the present value \(Y_t\) and the income \(y_t\). The implications of the above equations can be summarized: if the real estate market is rational, the house price and rent variables should be cointegrated, and the spread between the price and rent is stationary; without a cointegrating relation between the two, the spread is non-stationary and a “rational bubble,” which by definition is explosive, exists in the market.

Therefore, in this study we use cointegration between price and rent as a criterion for the existence of a bubble in the market. Although the cointegration relationship can identify the existence of bubbles, it cannot fully explain the cause of bubbles. In the following, we further investigate the causality of bubbles, originating from speculation.

Lease-Price Ratio. In South Korea, the lease-price ratio is often used as a measure of speculative investment in the real estate market. There are two types of house rents in the Korean real estate market. For the purpose of simplicity, we define these as lease and rent. If a tenant pays a monthly rent with or without a deposit and the landlord keeps the monthly rent paid, it is called rent. Lease is where tenants have to make a substantial deposit (normally between 50 and 80% of the house price) for no monthly rent during their tenancy. The landlord must refund the tenant’s lump sum deposit at the termination of the term, which is usually two years. The landlord receives interest income on the deposit or can invest the deposit in other assets. These returns from interest earnings can be considered as the value of monthly rents.

The lease-price ratio implies demand for speculative investment in the housing market. Yoon [33] noted that landlords might invest the deposits in the purchase of other houses for speculative purposes, thereby supplying more leases. A large proportion (approximately 70%) of landlords spends the deposits on purchasing another house or building [33]. The lease-price ratio can be a good proxy of speculative investment in a market bubble.

The KNS publishes the lease-price ratio every month. The lease-price ratio takes the form of the equation shown below:

We can assume that if there are more speculators than people who intend to actually live in a property, the lease-price ratio will decline because speculative supply is higher than demand for leases. Thus, we can effectively identify the speculative bubble if the ratio declines or stays low compared with other regions.

Still, it remains unclear whether the lease-price ratio is driven mainly by lease supply or by house price. Identifying the relationship between lease and price is important not only for explaining the lease-price ratio itself but also for understanding the speculative investment associated with lease supply. Therefore, prior to examining the lease-price ratio we analyzed the generalized spillover effect from lease to house price in accordance with [9, 18, 26]. We used a generalized vector autoregressive framework with forecast-error variance decompositions \(\theta _{ij}^g(H)\) for \(H=1,2,\cdots \). Variance decompositions allowed us to split forecast error variances of each variable into parts attributable to various system shocks [8]. This helps us to ascertain the direction of volatility spillovers across major asset classes. We measured the directional volatility spillovers received by index i from all others j as follows:

where we expressed the ratio as a percentage. In a similar fashion, the directional spillovers transmitted by index i to all others j can be measured as follows:

This gives us the net spillover from i to all others j as

Thus, we obtain the set of directional spillover effects while providing the total and net spillover indices.

The LPPL Model. One of the key ingredients of the LPPL is a power law, which is made up of a complex system, such as the economy. The power law theory indicates that the existence of a long tail, which occurs rarely, has huge effects. There is also a short head, which occurs frequently but with much less impact. Economic systems are unstable and complex, with fewer possibilities of causing a big loss, and so there are many economic phenomena that can be explained by the power law [6, 29].

With regard to the internal mechanism of the LPPL, there is a self-organizing economy under competing influences of positive and negative feedback mechanisms [30]. This feedback leads to herding behavior in purchases during a boom and in sales during a recession. In general, during a boom, because of investors’ overconfidence, imitative behavior, and cooperation among each other, investors re-invest in houses in expectation of higher prices later on, therefore this cycle goes repeatedly. Such positive feedback causes speculative bubbles and develops through the mechanism of herding behavior, which is a result of interactions between investors [34]. Collective behavior increases up to a certain point, called the critical time, from which the LPPL predicts the crash date of bubbles. Therefore, the critical time can be detected through signs of faster-than-exponential growth and its decoration by log-periodic oscillations [35]. Faster-than-exponential (super-exponential, hyperbolic, or power law) growth means that the growth rate itself is increasing while signaling an unsustainable regime.

Mathematically, these ideas are captured by the power law equation shown below:

where p(t) is the house price or index and \(t_c\) is an estimate of the bursting of bubbles, so that \(t<t_c\) and A, B, and \(\beta \) are the coefficients. An extension of this power law (4) takes the form of LPPL as follows

where \(y_t>0\) is the price or the log of the price at time t, \(A>0\) is the price at the critical time \(t_c\), and \(B<0\) is the increase in \(y_t\) over time before the crash when C is close to 0; \(C\in [-1,1]\) controls the magnitude of the oscillations around the exponential trend, \(t_c>0\) is the critical time, \(\beta \in [0,1]\) is the exponent of the power law growth, \(\omega >0\) is the frequency of the fluctuations during the bubble, and \(\phi \in [0, 2\pi ]\) is a phase parameter.

In this study, house price index was fitted to the LPPL model and seven parameters estimated to predict the critical time. The parameter set must be such that the root mean square error (RMSE) between the observed and predicted values of the LPPL model is minimized [2]:

where \(Y_t\) is the empirical value at time t. T is the number of trading dates.

2.2 Data

Condominiums are the single dominant housing type in Korea. In 2016, 48.1% of people lived in a condominium while 35.3% of people lived in single family house. In Sejong, about 60% of the housing supply was in the form of condominiums in 2015 and this figure increases up to 77% in 2017 [19]. The KNS office publishes the Condominium Transaction Price Index (CTPI) and the Rent Index (RI), a monthly measure of the price and rent changes, and they are normalized by 100 in January 2006 and June 2015, respectively. Since 2006, the CTPI has been used extensively as an authoritative indicator of house price movements in South Korea. It is based on the largest sample of housing data, especially condominiums, and provides the longest time series data compared with any other Korean house price index.

Using the datasets described in Table 1, we detected the housing bubbles, identified the types of bubbles, and estimated the critical time of bubble bursts. A series of house prices and rents are reported. The period examined was selected according to availability of the data (the RI is only available from June 2015).

3 Results

3.1 Does Sejong Have a Real Estate Bubble?

The results of the unit root tests for house price and rent are presented in Table 2. The cointegration relations between house price and rent are presented in Table 3. The cointegration test identifies the stationarity in \(S_t\), the spread (previously defined in (2)). The Dickey-Fuller (DF), Augmented Dickey-Fuller (ADF), and PP (Phillips-Perron) tests were used to examine for the presence of a unit root. Tests were carried out for house price and rent variables at various levels and on the first difference, with and without trends. The Johansen procedure was used for cointegration tests with an unrestricted constant and restricted trend. The lag length in the cointegration tests was selected using the Schwarz Bayesian information criterion (SBIC), Hannan-Quinn information criterion (HQIC), and likelihood-ratio (LR) tests. From these results, it could be concluded that both house price and rent are I(1) series, i.e., they have a unit root in their levels and are stationary after the first difference operation.

The stationarity of the spread was assessed using the cointegration test, and both \(\lambda _{max}\) and \(\lambda _{trace}\) are reported in Table 3. This shows that at the national level the null hypothesis, that there is no cointegration, can be rejected. However, for Sejong we cannot reject the null hypothesis. In other words, our evaluation of the present value model for real estate in Sejong indicates that the spread between house prices and rents is non-stationary, which can be influenced by a bubble, whilst the spread obtained at the national level shows stationarity. This suggests that a housing market bubble does exist in Sejong in contrast to the picture countrywide.

3.2 What Is the Cause for the Real Estate Bubble?

Figure 2(a) shows the changes in lease-price ratio for the whole country, Seoul, and Sejong. The ratio for Sejong city declines significantly, while that for the country as a whole and Seoul exhibits the opposite trend. Figure 2(b) indicates that there is more supply than demand in lease (95, on average for the last five years for Sejong). Put differently, the lease-price ratio is driven by the lease supply, which is higher than demand. As shown in Fig. 1(b), the percentage of empty houses is 20% much larger than the national level of 6.5%. This can be explained by the over-supply of lease units.

To support the theory of speculative investment in lease supply, we examined the relationship between lease and price using the generalized spillover effect from lease to price in Sejong. This result is important not only for explaining the decrease in lease-price ratio but also for understanding speculative investment associated with the lease. We found a strong gross and net spillover effect from lease to price in Sejong. Lease to price explained as 38.62%. In addition, the net spillover effects from lease to price were 12.46%. Thus, we confirmed that lease had significant effects on the real estate market in terms of the gross spillover from lease to price fundamentals.

As previously discussed in Sect. 2.1, lease supply implies an increase in speculative investment; therefore, it can be concluded that speculative investment caused the bubble. Moreover, the lease-price ratio decreases due to the increase in supply in the lease market, which can result in a lower lease level and an increase in house prices as investment goods. In Sejong, it appears that the supply of leases caused a spiral effect on the house price bubble.

3.3 When Could Be the Probable Critical Time of the Bubble?

In order to identify the critical time of the real estate bubble in Sejong and South Korea as a whole, we fitted the LPPL model with the CTPI datasets from November 2009 to December 2016 and from December 2008 to December 2016, respectively. In accordance with [4, 16], we selected the data period as follows: (i) the time window started at the end of the previous crash, which was the lowest point since the last crash; and (ii) the endpoint was the last day used to predict the future critical time of a real estate bubble. Figure 3(a) shows a monthly natural logarithm of prices sold in both Sejong and the entire country. The LPPL curve shows the best fit of the LPPL model to the data. A strong upward trend is observed in these LPPL plots, indicating a fast exponential growth in condominium prices in Sejong as well as in the wider country.

In Table 4, \(t_c\) represents the critical time estimated from the LPPL. It corresponds to the most probable time for a change in the regime or a crash to occur [14, 15]. In addition, it is important to validate the LPPL calibration, i.e., to check the stylized features of the LPPL reflected by restrictions on the parameters mentioned in [2]. All the estimated parameters are within the boundaries. The two conditions \(B<0\) and \(0.1\le \beta \le 0.9 \) ensure a faster-than-exponential acceleration of the log-price (mostly Sejong and Incheon in regard to \(\beta \)) [21]. The values of \(\omega \) are close to the lower bound 5 (especially both Sejong and Seoul), which corroborates existing studies such as that by Johansen [17], who found that \(\omega \approx 6.36\pm 1.56\) for crashes.

To diagnose the estimation results, three robustness tests were carried out. First, relative error analysis was conducted (Fig. 3(b)). According to [14] our results suggest that the LPPL model captures the bubble precisely, as the relative errors of these two indices are well below 5%.

To check the stationarity of residuals, unit root tests were conducted. ADF and PP tests were used with one to eight lags. Both test results rejected the null hypothesis at the 1% significant level, implying that the residuals do not have a unit root but are stationary.

Finally, we carried out crash lock-in plot (hereafter CLIP) analysis in accordance with [12]. The CLIP is useful for tracking the development of a bubble and understanding whether a possible crash is imminent. The main idea of the CLIP is to plot the date of the last observation in the estimation sample on the horizontal axis and the estimated crash date \(t_c\) on the vertical axis. To implement the CLIP, we continued in changing the last observation of our estimation sample on a monthly basis for Sejong and South Korea (Fig. 3(c)). From the resulting plot we confirmed that our estimation for \(t_c\) is stable.

As such, these results indicate that the predicted \(t_c\) is a robust and precise forecast. The critical time of the bubble in Sejong is January 2019, earlier than the November 2019 for the country as a whole and that in other major cities, reflecting a relatively and probably fast growth in house prices in Sejong.

4 Conclusion

This study comprehensively examined housing market bubbles in a newly developed city: its identification, cause, and burst-timing. Our findings can be summarized as follows. First, we identified a bubble in the Sejong housing market using the present value model. House prices and rental rates were cointegrated at the national level but the result for Sejong was different, implying housing market bubbles in the new city. Second, analysis of the lease-price ratio suggests that the housing market bubbles in Sejong were caused by speculative investors. The lease-price ratio in Sejong dramatically decreased, while that for Seoul and South Korea as a whole marginally increased over the same period. Furthermore, a significantly low lease-price ratio (59.1% on average) supports our conclusion that speculative investments led to an increased lease supply in the area. Third, it is predicted that Sejong’s critical bubble-burst time will be earlier than the country’s critical time. The LPPL model suggests that the critical time of the bubble in Sejong will occur ten months ahead of that for the rest of the country. Additional analysis shows that our results are robust. This implies that housing price in Sejong is at a riskier stage than those in other regions in South Korea.

Our results suggest that the real estate market in Sejong, the new city of South Korea, is at a high level of bubble relative to the rest of the country. Additionally, our analysis reveals the complex relation between housing market prices and leases in South Korea, which has in part supported the creation of real estate bubbles in Sejong. Our findings have two important policy implications for urban planning and new city policies: first, the housing market should be intensively monitored to prevent and detect bubbles, especially in newly developed cities; and second, managing lease and house prices at the same time would be an effective policy approach.

The approaches used in this paper can be applied to other areas. However, it should be noted that the results might not be universally applicable.

Notes

- 1.

In South Korea, the main type of housing is the condominium, as explained in the data Sect. 2.2. A condominium building consists of multiple attached units in a multi-story building, but ownership of each unit is separate. These types of condominium are referred to as apartments in South Korea. We use the term condominium (instead of apartment) throughout this paper.

References

Abraham, J.M., Hendershott, P.H.: Bubbles in metropolitan housing markets. National Bureau of Economic Research, w4774 (1994)

Ahn, K., Dai, B., Targia, D., Zhang, F.: Predicting the critical time of financial bubbles. PHBS Working Papers, 2016008 (2016). https://doi.org/10.1111/1540-6229.12154

Bourassa, S.C., Hoesli, M., Oikarinen, E.: Measuring house price bubbles. Real Estate Econ., 1–30 (2016)

Bree, D.S., Joseph, N.L.: Testing for financial crashes using the log-periodic power law model. Int. Rev. Finan. Anal. 30, 287–297 (2013)

Campbell, J.Y., Shiller, R.J.: Cointegration and tests of present value models. J. Polit. Econ. 95(5), 1062–1088 (1987)

Canning, D., Amaral, L.A.N., Lee, Y., Meyer, M., Stanley, H.E.: Scaling the volatility of GDP growth rates. Econ. Lett. 60(3), 335–341 (1998)

Clark, A.: Evidence of log-periodicity in corporate bond spreads. Phys. A Stat. Mech. Appl. 338(3), 585–595 (2004)

Diebold, F.X., Yilmaz, K.: Measuring financial asset return and volatility spillovers with application to global equity markets. Econ. J. 119(534), 158–171 (2009)

Diebold, F.X., Yilmaz, K.: Better to give than to receive: predictive directional measurement of volatility spillovers. Int. J. Forecast. 28(1), 57–66 (2012)

Faggio, G.: Relocation of public sector workers: Evaluating a place-based policy. University of London, October 2016

Faggio, G., Schluter, T., Berge, P.: The impact of public employment on private sector activity: evidence from Berlin. University of London, November 2016

Fantazzini, D.: Modelling bubbles and anti-bubbles in bear markets: a medium-term trading analysis. In: The Handbook of Trading, McGraw-Hill Finance and Investing, pp. 365–388. New York, U.S. (2010)

Filimonov, V., Sornette, D.: A stable and robust calibration scheme of the log-periodic power law model. Phys. A Stat. Mech. Appl. 392(17), 3698–3707 (2011)

Johansen, A., Ledoit, O., Sornette, D.: Crashes as critical points. Int. J. Theor. Appl. Finance 3(2), 219–255 (2000)

Johansen, A., Sornette, D.: Predicting financial crashes using discrete scale invariance. J. Risk 1(4), 5–32 (1999)

Johansen, A., Sornette, D.: Bubbles and anti-bubbles in Latin-American, Asian and Western stock markets: an empirical study. Int. J. Theor. Appl. Finance 4(6), 853–920 (2001)

Johansen, A.: Characterization of large price variations in financial markets. Phys. A Stat. Mech. Appl. 324(1), 157–166 (2003)

Koop, G., Pesaran, M.H., Potter, S.M.: Impulse response analysis in non-linear multivariate models. J. Econometrics 74(1), 119–147 (1996)

Korea National Statistics: National Census. http://kosis.kr/index/index.do

Kwon, Y.: Sejong Si (City): are TOD and TND models effective in planning Korea’s new capital? Cities 42, 242–257 (2015)

Lin, L., Ren, R.E., Sornette, D.: The volatility-confined LPPL model: a consistent model of ‘explosive’ financial bubbles with mean-reverting residuals. Int. Rev. Financial Anal. 33, 210–225 (2014)

Lind, H.: Price bubbles in housing markets: Concept, theory and indicators. Int. J. Hous. Markets Anal. 2(1), 78–90 (2009)

Lyons, M.: Well Placed to Deliver? Independent Review of Public Sector Relocation. Shaping the Pattern of Government Service (2004)

Meese, R., Wallace, N.: Testing the present value relation for housing prices: should I leave my house in San Francisco? J. Urban Econ. 35(3), 245–266 (1994)

Mikhed, V., Zemčík, P.: Do house prices reflect fundamentals? Aggregate and panel data evidence. J. Hous. Econ. 18(2), 140–149 (2009)

Pesaran, M.H., Shin, Y.: Generalized impulse response analysis in linear multivariate models. Econ. Lett. 58, 17–29 (1998)

Roche, M.J.: The rise in house prices in Dublin: bubble, fad or just fundamentals. Econ. Modell. 18(2), 281–295 (2001)

Roehner, B.M.: Spatial analysis of real estate price bubbles: Paris, 1984–1993. Reg. Sci. Urban Econ. 29, 73–88 (1999)

Sornette, D.: Discrete-scale invariance and complex dimensions. Phys. Rep. 297(5), 239–270 (1998)

Sornette, D.: Why Stock Markets Crash: Critical Events in Complex Financial Systems. Princeton University Press, Princeton (2009)

Takamura, Y., Tone, K.: A comparative site evaluation study for relocating Japanese government agencies out of Tokyo. Soc. Econ. Plann. Sci. 37(2), 85–102 (2003)

Wang, P.: Market efficiency and rationality in property investment. J. Real Estate Finance Econ. 21(2), 185–201 (2000)

Yoon, J.: Structural changes in South Korea’s rental housing market: the rise and fall of the Jeonse system. J. Comp. Asian Dev. 2(1), 151–168 (2003)

Zhou, W.X., Sornette, D.: Is there a real estate bubble in the US? Phys. A Stat. Mech. Appl. 361(1), 297–308 (2006)

Zhou, W.X., Sornette, D.: 2000–2003 real estate bubble in the UK but not in the USA. Phys. A Stat. Mech. Appl. 329(1), 249–263 (2003)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this paper

Cite this paper

Jang, H., Ahn, K., Kim, D., Song, Y. (2018). Detection and Prediction of House Price Bubbles: Evidence from a New City. In: Shi, Y., et al. Computational Science – ICCS 2018. ICCS 2018. Lecture Notes in Computer Science(), vol 10862. Springer, Cham. https://doi.org/10.1007/978-3-319-93713-7_76

Download citation

DOI: https://doi.org/10.1007/978-3-319-93713-7_76

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-93712-0

Online ISBN: 978-3-319-93713-7

eBook Packages: Computer ScienceComputer Science (R0)