Abstract

This paper analyzes German and Australian health insurer programs that offer self-tracking options for customers. We considered aspects of program promotion, program goals, and data privacy issues. Results are based on scanning current information available online via insurer websites. Seven Australian and six German insurers apply self-tracking. Programs in both countries vary, whereas most Australian insurers build their programs on third-party providers, and German insurers offer direct financial rewards. Those differences may be reasonable due to diverse health systems in both countries. Commonalities regarding the programs’ intentions are obvious. Furthermore, concerns about data policies arise across countries. The reward systems and intended program goals vary. The outcomes give insights into the status quo of self-tracking health insurer programs and contribute to a better understanding of the use of self-tracking data by providers. Moreover, further questions arise about the benefits of those programs and the protection of sensitive self-tracking data.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Self-tracking one’s health and fitness status have become very popular. A GfK study from 2016 says that 33% of online users (across 16 countries) are monitoring or tracking their health or fitness either via an application (online or mobile) or via wearables (fitness bands, clips, smartwatches). The market for wearables that track a person’s activities is still growing and new vendors that sell luxury and fashion devices are entering the market [1, 2].

The popularity and the ability of those technologies have attracted health insurers as well. About three years ago, the first health and life insurers, mainly in the United States, but in other countries as Australia and Germany as well, started to offer discounts for customers that track their fitness and reach a determined fitness goal. Life insurer AIA started its program in Australia in 2014 and cooperates with health insurers [3]. In 2015, a local affiliation of the AOK was the first health insurer in Germany subsidizing the Apple Watch [4].

Since then, discussions emerged on the use and misuse of self-monitored fitness data [5]. Moreover, research on fitness and activity trackers showed the technologies’ inaccuracies [6] and low long-term effects on people’s health behavior [7, 8]. However, health insurers seem to get ready to establish new programs that include self-monitoring and tracking of health data. Tedesco et al. [9] summarize current reports that forecast insurers will invest in new technologies like wearables and partner with digital technology providers to engage customers and offer new services.

The following paper aims at giving an overview of the current status quo of health insurances that investigate self-tracking opportunities and possible rewards for customers that share their fitness and health activities. We are interested in how insurers promote their health and well-being programs (intended program goals) and motivate customers to live healthier (incentives). We introduce research in progress while firstly focusing on the countries Germany and Australia. We discuss the current situation of health insurance clients’ data use, data security issues as well as long-term health benefits regarding those programs based on recent research on self-tracking activities. The research questions are:

-

1.

Which health insurers offer options for clients to self-track health and fitness data?

-

2.

How do insurers communicate about the programs?

-

3.

How do those insurers communicate about data security?

2 Methods and Limitations

To find current health insurance programs that offer self-tracking, we decided that this could be done best while reviewing health insurance websites as well as media reports (news articles, blogs, and insurance comparison services). We did this first review with regard to scope the landscape of current programs to be able to investigate future research based on this status quo (compare Gough et al. [10] and Arksey and O’Malley on the aims of a scoping review [11]). Health insurance programs are all activities health insurers offer to their customers and that relate to aspects concerned with the customers’ health and well-being. Some insurers explicitly name their programs, i.e. they establish specific programs that include diverse services related to fitness, well-being, and lifestyle (accessed for example via an application). Others list their activities as part of their overall services. We aimed at finding all activities related to self-tracking.

As the German and Australian health system differs, we have to distinguish between insurance types. Australia has a public health insurance (Medicare) funded by tax levy. Medicare does not offer any additional health program services. Besides, there are currently 38 private health insurances, whereof 25 are open to all employee groups and available in all eight statesFootnote 1. Private health insurance is additional health cover to that provided under Medicare, to reimburse all or part of the cost of hospital and/or ancillary services incurred by an individual. In 2014–15 there were 10.1 million adult Australians with private health insurance (57.1% of all people 18 years and over). This was the same rate as in 2011–12, but an increase from 2007–08 (52.7%) [12]. Australia has 24.5 million citizens (Mar 2017) [13]. We considered all 38 Australian insurers officially listed by the government.

Germany has a law enforced statutory health insurance (or public health insurance). 72.26 million (about 88%) of the population are covered by statutory health insurance (SHI) while private health insurance (PHI) covers 8.77 million people (about 11%) [14]. There are currently 110 health insurers [15] listed of which we identified the 30 biggest SHIs and 10 biggest PHIs, defined by the number of insured persons [14]. As we lack an official resource, we based our number on diverse sources to define the 40 SHI and PHI with the highest number of customers [14, 16].

The following paper discusses health programs of 38 Australian and 40 German health insurers. A full list of all insurers examined is published online [17]. We reviewed the programs based on website information by the insurers in December 2017, and searched for updated information in February 2018 as many insurers change their programs every year.

The described review method is not free of limitations. First, result rely on information published by health insurers. During our research, we realized that finding specific information about health programs is hard. Some insurers, specifically Australian providers, base their services on personal customer relations, therefore. In Germany, there are many health insurances and no central service that stores all necessary information consistently and exhaustively. Especially information on private health insurance is scarce. While collecting information for our analysis, we did so to the best of our ability, but cannot guarantee absolute exactness. Furthermore, as we did not reach out to health insurers to ask them personally, this first review study might miss relevant details on programs. Second, some of the apps that provide main access to services are only accessible for recent customers. Regarding the apps’ functions, we relied on the descriptions by insurers and at application store sites whenever there was no (demo) version open to the public.

The article is structured as follows. We will introduce current literature and reports on self-tracking and eHealth in Sect. 3, before we show results on the German and Australian health insurance programs (Sect. 4). Afterwards, we will discuss the findings (Sect. 5) and conclude with arising questions that need to be investigated in future (Sect. 6).

3 Related Literature

Research on digital health technologies discusses effects and impact on people and their health behavior, including fitness tracking devices, mobile applications, and online services, but as well health data usage by health providers, insurers and research. Moreover, studies investigate new forms of communication between public and health professionals and aspects of health information communication that can be summarized under the term health promotion [18, 19]. The following study is interested in two issues: Offered self-tracking options by insures - via using new technologies like tracking devices and mobile apps - as well as information disseminated about this offer.

Self-tracking, self-monitoring or ‘quantified self’ refer to all aspects concerned with personal data, its analytics and sharing with others. It is about “the practice of gathering data about oneself on a regular basis and then recording and analyzing the data to produce statistics and other data (such as images) relating to regular habits, behaviors and feelings [20].” The ‘self’ hereby emphasizes the fact that oneself is the actor of collecting this data and is aware of being tracked [21]. Another relevant aspect is the focus of improving oneself, i.e. “‘live by numbers’ […] to quantify and then optimize areas of one’s life [22].”

Today, digital developments like apps and devices support this process. Smart devices instantly track activities, store data and automatically analyze them to provide insights into the quantified self. The website ‘Quantified Self’Footnote 2 gives an overview of technologies and application. Regarding the numbers, health and fitness support seem to be most popular. Many digital services hereby provide automatic self-tracking, where the device – a smartphone, smartwatch, or trackers and life-loggers specifically designed to track personal actions – registers one’s activities. This paper focuses on both, self-tracking activities that are traced either with the help of devices or registered by oneself.

Various studies regarding fitness and health concerns focus on user motivation. They discuss users’ ability to understand data and fitness goals. Asimakopoulos et al. [23] worked with Fitbit and Jawbone users and applied self-determination theory elements. They remark that users have difficulties to interpret device data and gain motivation from it, due to a critical user experience regarding the fitness tracker apps. For example, users found some graphical visualizations useful, other means of data presentation were found less useful. Users were not aware of being able to edit their goals (like steps per day or sleeping hours) either. Moreover, the authors stress that goals are kind of pre-defined by the fact that the device has predefined tracking options. They conclude that “motivational relevancy of content […] should support a users’ immediate as well as overall intrinsic goals” [23]. Donnachie et al. [24] conducted a 12-week study with 28 obese men, analyzing factors of self-determination. They found out that intrinsic motivation leads to better long-term effects, i.e. participants continued their personal activity and were more satisfied in doing so. In contrast, participants with extrinsic motivations adopted a more rigid approach to exercise behavior but failed in long-term activity behavior changes. The last group reported pedometers as “undermining” or “controlling” rather than motivating. In addition, for these participants, group motivation seemed more important and once the activity program they participated ended, they stopped their activities. Rowe-Roberts et al. [25] conducted a 7-month study with 212 employees. Results showed that activity trackers can improve a person’s fitness and health risks. Moreover, participants with high health risks were more active and more engaged, i.e. they had more steps/day on average and used the tracker for a longer period than participants classified as low- or medium risk. However, further survey data revealed that the devices themselves might not be the main factor for behavior change. Participants that were not active reported a general lack of motivation or lack of time, and suggested a need for additional motivation, like fitness games for example. Other studies showed that game mechanics [26], remote coaching [27] and social networking [28] are the driving motivators to change activity behavior. Glance et al. [29] showed that participants in teams are significantly more active than individuals (average daily steps). If health insurers’ tracking programs intend to support their clients to get healthier and more active, insurers need to consider factors of communicating and engaging in those programs. In the following study, we are interested in the way insurers promote their programs (intended program goals) and try to increase user motivation (incentives).

Related to the above aspects are social, economic and political issues of digitized and tracked health data. Lupton [19] raises concerns about “socio-political implications of digitizing health promotions.” Digital health data containing sensitive information on people’s health and well-being are already part of a large network of a complex economy, where providers of self-tracking devices, health promoters and health insurers participate. Currently most of the health promoting programs aim at changing people’s behavior towards a healthier lifestyle with a rather prescriptive “top-down approach”, while not considering individual circumstances and the limitations of the meaning of quantified health data [19, 30]. Purpura et al. [30] discuss the boundaries between persuasion and coercion. Health programs and fitness devices often apply generalized standards and an ideological assumption by designer that then tell users best ways to get healthier and fitter: “[…] the key distinguishing feature that concerns us with the persuasive computing literature is that users do not get to choose their own viewpoints” [30]. Those points are critical when examining self-tracking programs by health insurers. Which goals do insurers have with their programs? How do those programs communicate health and fitness aspects to users? Which economic and social concerns do those programs implicate?

Another issue arising with the advent of digital health technology for personal activity and fitness tracking is the handling and protection of personal sensitive data. While retailers recognize many opportunities regarding individualized data mining and personalized product recommendations [31], the fear of data breaches, inference, identity theft or other risks connected to creating and transmitting health-related data grows. Indeed, among current “personal IoT devices, fitness trackers are those that have the most number of sensors and capable of collecting the most sensitive information” [32]. In the context of sharing such data with health insurers, the fear of “inference attacks” might be the most pressing one:

Though third parties are authorized to access and process the personal information of users [there is the risk that] these trusted third parties can breach privacy statements and infer sensitive information that was not shared by the user. These attacks are typically known as “inference attacks” where private information can be derived by exploiting the available data provided by the user to the third party [32].

Besides self-tracking program promotion and user motivation increase, this paper as well reviews data privacy statements of self-tracking programs. In the following, we will report on the results of the scoping of current health insurer self-tracking programs in Germany and Australia, before we discuss the introduced issues around digital health technologies.

4 Results

In the following, we show results of our review on the status of health insurance programs that relates to self-tracking activities, and refer to our three research questions. We distinguish between two different types of self-tracking. Self-tracking via wearables (fitness tracking devices) that allows for automatic synchronization of data, and self-tracking via manual user input, where users themselves share information, for example about their daily steps, heart rate, weight loss etc.

4.1 Do Insurers Offer Self-tracking Programs?

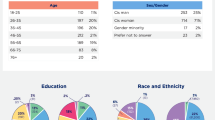

Seven Australian and six German health insurers offer self-tracking related programs (Table 1). We will summarize the findings in the following.

German Health Insurance.

For 25 out of the 40 insurer’s websites, we can say that we found all needed information regarding bonus programs, activity tracking (if applicable) and data handling. All other websites had restrictions, i.e. you had to log in or contact the insurance company to get more information. This is especially the case with all 10 PHIs we analyzed. For the SHIs, there were only 5 out of 30 cases where not all information was publicly accessible, and only 2 out of those did not have sufficient information available to confidently determine whether an activity tracking program or activity tracker subsidy was offered.

We identified six German insurers, five SHIs and one PHI, who support activity tracking in their programs and/or via apps provided (see Table 1). We also found ten insurers who at least subsidize the purchase of an activity tracker or even apple watch in any way.

“AOK Bonus-App” (AOK Plus), “FitMit AOK” (AOK Nordost) and “TK-App” (Techniker Krankenkasse) are applications that offer automatic activity tracking to their customers. Regarding the content and the reward system, “AOK Bonus-App”and “FitMit AOK” have many similarities: Customers can link to a tracking application (Google Fit, Apple Health) to convert steps, caloric deficits, and heart rate into points for the insurance’s bonus program. In the apps, collecting points is also possible by sending proof of treatments or preventive check-ups (e.g., blood donations or cancer screening). The point system relates to a level system (Fig. 1). Depending on the level of the user (e.g. beginner, expert, champion) different bonuses and discounts are available for local cooperation partners from the sports and health sector. Furthermore, customers can get a cash bonus reward through the app at the end of each year.

Techniker Krankenkasse offers a much more comprehensive application. It as well can synchronize with Google Fit or Apple Health to transfer steps into the insurer’s system. 600.000 steps per week are necessary to get 500 points for the health insurance bonus program. These, in turn, can be paid out as cash bonus. In addition to track one’s activities, customers get an overview of medication and prescriptions. Furthermore, they can send sick reports and receive letters from the health insurer. “Fit2Go” (BARMER) and “Family Adventure with Fred” (IKK Südwest) offer self-tracking, but provide no rewards in return. While “Fit2Go” supports the usual step counting functionalities, “Family Adventure with Fred” is meant to engage whole families in hiking and walking adventures (Fig. 1).

“Sijox AppLife” (SIGNAL IDUNA) is only available with the purchase of one specific insurance package. The synchronization with Apple Health or Google Fit allows users to convert steps into a cashback of up to 42% for SIGNAL IDUNA’s disability insurance. Performance graphs show user activity. The application has a timer that measures the duration of an activity. Customers can see their cashback amount clearly at the top center of the dashboard (Fig. 1).

While we could only identify six German insurers, who support activity tracking right now, we also found ten insurers who at least subsidize the purchase of an activity tracker: Techniker Krankenkasse, DAK Gesundheit, AOK Plus, AOK Nordost, KKH Kaufmännische Krnakenkasse, BKK Mobil Oil, IKK Südwest, Bahn-BKK, hkk Krankenkasse, and BIG direkt gesund. These insurers might develop activity tracking programs in the future.

Australian Health Insurance.

In Australia, only the insurer HBF offers its own app (My Pocket Health, Fig. 2). Customers can manually input their fitness activities, store health information (e.g. x-rays or test documents), and manage a calendar (e.g. with doctor appointment, vaccinations and medication times). Automatic self-tracking is not possible, there is no reward system related those activities. All other Australian insurers use services from external providers, i.e. they offer customers the opportunity to use those services. Two insurers use the service of a health management provider, HealthwaysFootnote 3 (Fig. 2). Healthways is a B2B-provider that offers personalized health programs like assessments, care management and coaching. Neither Healthways nor their insurance partners HCF and St. Lukes Health offer any rewards participating in programs.

Four insurers use external providers and as well the reward system offered by those. Customers can collect points for their activities. Life insurer AIAFootnote 4, who entered the Australian market in 2014, cooperates with two health insurers (GMHBA Limited and myOwn Health, cofounded by GMHBA and AIA) and offers its Vitality program. Costumers collect points, get a higher ‘AIA Vitality Status’ and receive discounts on services and products of third-party providers. Similarly, Medibank Private and Flybuys cooperate. Medibank customers are able to get extra Flybuys points (10 for 10,000 steps a day) when they synchronize their fitness activities. Manually uploaded steps are not considered. FlybuysFootnote 5 is a large Australian loyalty program, where customers collect point when shopping with participating retailers. Medibank customers are able to receive extra points when they link their Flybuys and Medibank membership. For example, they get extra points for buying fresh fruit at Coles supermarket. To get 10 points for achieving 10,000 steps per day, customers have to link a Fitbit device to their Flybuys account.

NIB Health Funds has a cooperation with Qantas Airways. Together they established a new health insurance service, Qantas Assure that offers rewards for fitness activities Fig. 2). Customers can get 25 points for achieving 10,000 steps a day. The Qantas app measures activities with a phone or via a wearable device. NIB as well offers discounts on premium insurances (via Qantas Assure) for customers that have collected adequate fitness points. GMHBA established a similar offer. Their extra insurance packages are cheaper for customers that participate in the AIA program and receive a high AIA Vitality status.

All programs that offer rewards require automatic synchronization via a phone or wearable fitness tracker. The relevant activity that counts for rewards points is daily steps, referring to the current general recommendation of steps per day [33]. AIA offers diverse options to gather points, e.g. through tracking calories, speed and heart rate data – here, specific conditions the number of points that a user can collect apply.

It is striking that German insurers seem to rely on their own applications for managing their self-tracking reward programs. Only one Australian insurer built its own application (without the option to automatically self-track). However, applications that try to facilitate customers services are established in Australia as well. Those apps allow customers to make claims, to upload health-related documents, or to contact insurers.

4.2 How Do Insurers Communicate About Programs?

German Health Insurance. German insurers do not prominently advertise activity tracking on the websites. In most cases, the established bonus programs include activity tracking. While all SHIs we analyzed offer a bonus program (2017 and 2018), many still use paper sheets, which members and/or their practitioners can fill out to record any preventive treatment or check-up. The insurances that offer activity tracking do not actively advertise this feature, but describe the bonus programs and activities more generally on the related websites and/or in digitized flyers and booklets. We found that information by searching for “bonus program” or similar terms via the sites’ own search box or by looking for the appropriate category in the website menu. Most insurers state that their bonus programs exist to prevent illness and promote health, but do not describe details regarding for example particular health benefits. They use more general motivational phrases, as “take your health seriously”Footnote 6, “show what you got”, or “don’t lose time”Footnote 7. The reward, which in the cases mentioned is money (cashback or credit), is mentioned in phrases like “a healthy lifestyle pays for you”Footnote 8, “good for your health and for your pocket” (see footnote 6), or “get money back with every step”Footnote 9. Almost all insurers develop and use their own app and underline the ease of use and convenience (“available 24 h”, “fast”, “easy”). AOK Nordost particularly emphasizes the novelty of their “digital program” and describes it as “completely mobile, fast and save and “a new way of communication” (see footnote 8). PHI Signal Iduna promotes its Sijox AppLife on its own website under its own domain. Here, users are encouraged to “protect [themselves] against occupational disability” and warned that “every 4th German becomes unfit for work during their working life” (see footnote 9).

As BARMER and IKK do not offer any rewards for their activity tracking apps, they focus on the health and motivational aspects of tracking. While BARMER describes the “Fit2Go App” as “your perfect partner on your way to more activity” and its use as “easier than you think”Footnote 10, IKK concentrates on family well-being and values, e.g. “so that you and your family stay healthy”, “promote health literacy among your children”, “let your children develop a healthy lifestyle”.Footnote 11

Australian Health Insurance.

All programs are considered as additional benefits to the general health insurance services. Terms often used are fitness, well-being, wellness, and lifestyle (Fig. 3), whereas programs that relate to popular rewarding points like the cooperation between Medibank and Flybuys emphasize the rewards. In contrast, HBF emphasizes on the easy management of health and fitness related information, data, and documents. Users are able to store any relevant information in the app and are as well able to share this information via My Pocket Health app. GMHBA (Fig. 3) promotes its new insurance packages (AIA Vitality V Plus) with the ‘know your health, improve your health, enjoy the rewards’Footnote 12. There is a focus on the aspect of improving one’s fitness and at the same time enjoying a better lifestyle, i.e. being able to afford enjoyable products on discount (like spa and wellness treatments, travel offers). The HCF website offers an online brochure that gives very precise information about My Health Guardian. It emphasizes that users can personalize fitness and eating plans to choose what fits best for them “into their daily routine”. Qantas Assure describes its self-tracking program as “wellness rewards”. It points out that any activity gets tracked within their program. Members who own an appropriate device can track their running, walking, cycling, swimming. They as well promote family membership and the opportunity for kids to earn points through activities. The information website of St. Lukes (My Health Guardian by third-party provider Healthways) emphasizes that the program offered is for “preventative health” care and for “members who are generally healthy […] to help you look after your health” (Fig. 3Footnote 13). Moreover, the website uses terms that focus on the self-management of improving one’s health. St. Lukes as well hints to daily well-being challenges to keep users motivated.

Health insurers clearly distinguish their tracking and reward programs from their general health-related services. One main reason for this is legislation to which health insurers are bound, and that regulates payments of services offered by insurers [34]. In contrast, all German health insurers offer reward programs as kind of ‘bonus’ for customers. Customers that behave accordingly (e.g., doing preventive medical care), are able to get financial or item rewards directly from the health insurance.

Some insurers did inform about self-tracking fitness devices, for example on their blogs. In most cases, they give neutral information. Medibank has a health and fitness blog and talks about tracking and devices: “Tracking your activity can be an excellent way to motivate yourself and keep you reminded of your goals.”Footnote 14 However, they do not mention their program they started with Flybuys in 2016. Other insurers clearly state that they are not interested in offering self-tracking reward options, for example due to data security reasons [35].

4.3 Data Privacy

When analyzing health insurer websites, we as well focused on data handling. Do insurers use the data to create statistics? Is there a possibility of inference? We have not found any evidence for that so far. Although data is handled differently in the two countries, most providers state that actual activity data is not saved by the insurance. However, please note that we are not interested in proving data privacy statements according to national standards and legal requirements. We are mainly interested in how insurers communicate about data privacy issues – specifically when other providers are involved – and if they provide information on personal health data sharing.

German Health Insurance.

German Health Insurances put a strong emphasis on data security when communicating about their tracking services and apps. AOK Nordost, for instance, describes the protection of personal data as a “central concern” (Table 2). Regarding activity data they clearly state that only the bonus points for the processing of the bonus program and no actual fitness data is collected and stored. This is also true for AOK Plus, BARMER and Techniker Krankenkasse (Table 2). It becomes clear that these insurers want their customers to trust them and their technology – not only through the high level of transparency and comprehensibility of these information, but also through formulations such as “we want you to feel confident in using our app” and “the protection of your personal information is very important to us.”

In contrast, other insurers like Signal Iduna (“Sijox AppLife”) and IKK (“Family Adventure with Fred” developed by MuuvitFootnote 15) do not seem to be concerned to communicate data privacy issues clearly. Data handling and protection information on their websites is somewhat hidden and the language used rather vague. This is comparable to what we found on other websites, Moreover, it stays unclear, which data they store.

Australian Health Insurance.

Most health insurers clearly state that they do not have access to any personal health and fitness data self-tracked by customers. However, regarding the external provider party apps, insurers refer to the provider’s data privacy statements and their conditions. In Table 2 we collected excerpts of those data privacy statements regarding the handling of self-tracked data.

Insurers’ third-party providers need to share information to offer rewards to eligible customers. MyOwn Health for example states they need to know customers activities to check their eligibility. They are very clear about the data they receive. In other cases, it remains ambiguous what personal information means for the insurers. Insurers that do not offer rewards, like St. Lukes, explicitly state that they do not have access to data collected by Healthways. However, Healthways does state to disclose personal information to insurers. Unlike examples in German statements, Australian insurers do not mention if they store personal data and for how long.

5 Discussion

Besides the number of health insurers – 38 in Australia and over 100 in Germany – self-tracking fitness data options are still an exception. However, the number of insurers offering self-tracking options has been increasing since the last three years, with currently seven Australia and at least six German insurers investigating self-tracking (Feb 2018). Medibank started its cooperation with Flybuys in 2014, whereas the Qantas Assure program was launched in 2016. Moreover, new players like life insurer AIA or health program provider Healthways cooperate with insurers. Healthways and AIA currently work together with two Australian insurers (offering two diverse funds each). Life insurer AIA started its program in Australia in 2014 [3].

It is striking that the business models and ways of offering self-monitoring services differ remarkably. Tracking options for clients varies. All Australian insurers except one (HBF) cooperate with third-party providers that establish health assessments, well-being programs and user interfaces (online and app) to make those programs accessible. Those partners as well offer rewards for fitness activities. In Germany, six health insurers promote self-tracking programs. In contrast to Australian insurers, most German insurers are able to reward their customers. For example, clients of the Techniker Krankenkasse receive cash bonuses for tracking their fitness with the mobile application.Footnote 16 Furthermore, most build their own mobile applications to allow self-tracking.

In the following, we will discuss the program in relation to outcomes of self-tracking research and data privacy concerns, and we will finish with open questions that arise from the status of self-tracking health insurance programs.

5.1 Effects of Insurer Programs

Most current programs rely on either a reward system that offers direct financial benefits (Germany) or indirect benefits via third-party products (Australia, e.g. Flybuys or Qantas flyer points). Another motivational factor to increase people’s activity rates seems social engagement. Studies reveal that users want to engage and interact with other users (family members or online users), like having support, challenges and competitions [18, 30]. A study by Zhang et al. [36] showed that the competitive factor is even more relevant than the support factor. Participants that had access to rankings of peers and their activities (no matter if they got individual or team incentives), were more motivated to join exercise classes than those that were not in a team or those, who only got team support, but no access to any comparative peer rankings. Rooksby et al. [22] speak of social tracking and emphasize that play, competition, but also friendship and peer support are important for people. We see that current programs try to implement challenge features (like AIA, Qantas and My Health Guardian). Australian health insurer (HBF) enables customers to share their activities with friends, a feature that they emphasize in their program promotion. In Germany, we could not find anything similar – this may be due to the high value both insurers and users put on privacy and data protection.

Another factor to consider is the generalization of program intended goals. Exercise and Sports Science Australia (ESSA) notesFootnote 17 that the use of activity tracking devices and the general goals related a healthy lifestyle, like 10,000 steps per day, might not be desirable and beneficial by everyone. People with chronic conditions might need to achieve different fitness behavior. Aiming for a more beneficial and long-term effect on personal fitness behavioral, insurance programs need to be able to adapt to personal conditions and circumstances. AIA Vitality already combines its self-tracking options with a health assessment test that users do before they start tracking their activities. Activity levels refer to the assessment results. As well, HCF talks of a personalized health program (My Health Guardian by Healthways) that supports customers to “progress towards [their] chosen health goal” and is able to schedule “exercise activities into [their] daily routine”Footnote 18.

However, the question is if self-tracking programs consider diverse ranges of customers in a way that is beneficial for customers. Lupton [19] raises this concern as well and criticizes that current health promotion acts against people who already suffer from socioeconomic disadvantages. Social inequities for example exist regarding people’s health and digital literacies. Those groups are not able to take advantage of digital health programs, or as well do not understand the information their personal data is able to reveal about themselves. Moreover, current health insurer programs show another concern. Financial unprivileged people might not be able to afford access to current self-tracking health programs. For example, programs offered by GMHBA in cooperation with AIA or the Sijox AppLife program by Signal Iduna are only available for customers who purchase specific insurance packages. These social aspects relate to the following concern, the use and interpretation of sensitive personal data.

5.2 Data Privacy Concerns

Until now, there are not many user studies, which give insights on people’s opinion, perception and behavior regarding health and activity data privacy. Yoon, Shin, and Kim report two directions regarding privacy concerns: “unnecessary anxiety” and “vague fear“. Lehto and Lehto [37] conducted qualitative interviews about the sensitivity of health data. They found that “information collected with wearable devices is not perceived as sensitive or private” by most users. The authors state that handling of tracked data “needs to be described clearly and transparently to mitigate any privacy concerns from the individuals.” In another attempt to understand the privacy concerns of fitness tracker users, Lidynia et al. [38] conducted an online survey (n = 82). Here, participants preferred to keep logged data to themselves.

When it comes to the legal situation, however, many researchers agree, that “[i]n most countries, laws that govern the collection, storage, analysis, processing, reuse, and sharing of data (…) fail to adequately address the privacy challenges associated with human tagging technologies” because they were “enacted decades ago” [39]. Although those legal issues are being worked on, the current situation is one of uncertainty.

Till [40] reports that although companies state that they do not sell identifiable information, studies found proof that they share user data. There are numerous reports about company activities exchanging data, including personal sensitive data like names and email addresses, activity and diets information [41]. Data privacy policies of health and fitness apps are not always clear about sharing and personal user data [42]. Some Australian health insurers refer to data privacies of the cooperating companies that arrange self-tracking options. Many do not. The definition of personal and sensitive data is ambiguous and inconsistent. Another critical issue is the relationships between health insurers and external health providers in Australia. Those providers rely on successful programs and active customers to be profitable. Interest in the commercial value of personalized data is obvious.

Moreover, recent research shows that activity tracker data like steps, heart rate, sleep, and location, might infer latent sensitive information, like drunkenness, fever or smoking [43,44,45]. Thus, tracker data becomes more powerful to reveal details about personal health and lifestyles. Users and experts alike fear that sharing tracked data with health insurance might mean that disadvantaged people will end up paying higher insurance premiums in the future. Health insurers offering those programs need to establish mechanisms that allow for credibility and user trust. One aspect might be transparency regarding data privacy policies. The question is, if those policies – regardless of them being applied according to effective law – need to be changed to increase trust and credibility.

6 Conclusion

We gave an overview of the status of German and Australian health insurance programs that allow for self-tracking by their customers. We found 13 insurers and examined their programs, as well as the communication about the programs’ intentions and data privacy policies.

German insurers offer their own programs and apps, whereas most Australian insurers rely on third-party providers. Communication about programs is similar in both countries, but twofold. Insurers that do not offer rewards try to persuade customers to join the programs with emphasizing support in managing personal health and fitness plans. Insurers that offer rewards are emphasizing the benefit of the rewards, like cashback, discounts for products or services. Some products or services relate to health and fitness aspects, many are not. Although participation in those programs is voluntary, questions regarding disadvantages of unprivileged people arise. Major concerns arise with data privacy statements and ambiguous information on data sharing practices between companies. This is specifically the case, when third-party providers are involved. Statements do not always give a clear definition of personal information. Data sharing is required to prove if customers are eligible for rewards, as insurers and third-party providers state. German insurers seem more concerned about data privacy. They as well communicate about aspects of sensitive data storage. Future research needs to investigate if insurer programs with self-tracking options are contributing to the improvement of people’s individual health and well-being, if they cause any discrimination on unprivileged groups, and if we need to reconsider privacy policies to prevent misuse driven by economic and political ambitions.

Notes

- 1.

- 2.

- 3.

- 4.

- 5.

- 6.

- 7.

- 8.

- 9.

- 10.

- 11.

- 12.

- 13.

- 14.

- 15.

- 16.

- 17.

- 18.

References

Van der Meulen, R., Forni, A.A.: Gartner says worldwide wearable device sales to grow 17 percent in 2017 (2017). https://www.gartner.com/newsroom/id/3790965. Accessed 15 Dec 2017

Ubrani, J., Llamas, R., Shirer, M.: Wearables aren’t dead, they’re just shifting focus as the marketgGrows 16.9% in the fourth quarter, according to IDC (2017). https://www.idc.com/getdoc.jsp?containerId=prUS42342317. Accessed 15 Dec 2017

Liew, R., Binsted, T.: Your insurer wants to know everything about you (2015). http://www.smh.com.au/business/retail/your-insurer-wants-to-know-everything-about-you-20151201-gld5t1.html. Accessed 15 Dec 2017

Mihm, A.: Erste Krankenkasse zahlt für Apple Watch (2015). http://www.faz.net/aktuell/wirtschaft/unternehmen/aok-erste-krankenkasse-zahlt-fuer-apple-watch-13736118.html. Accessed 15 Dec 2017

Boyd, A.: Could your Fitbit data be used to deny you health insurance? (2017). https://theconversation.com/could-your-fitbit-data-be-used-to-deny-you-health-insurance-72565. Accessed 15 Dec 2017

Yang, R., Shin, E., Newman, M.W., et al.: When fitness trackers don’t ‘fit’. In: Proceedings of the 2015 ACM International Joint Conference on Pervasive and Ubiquitous Computing (UbiComp 2015), pp. 623–634. ACM, New York (2015). https://doi.org/10.1145/2750858.2804269

Shih, P.C., Han, K., Poole, E.S., et al.: Use and adoption challenges of wearable activity trackers. In: Proceedings of iConference. iSchools (2015). http://hdl.handle.net/2142/73649. Accessed 15 Dec 2017

McMurdo, M.E.T., Sugden, J., Argo, I., et al.: Do pedometers increase physical activity in sedentary older women? A randomized controlled trial. J. Am. Geriatr. Soc. 58(11), 2099–2106 (2010). https://doi.org/10.1111/j.1532-5415.2010.03127.x

Tedesco, S., Barton, J., O’Flynn, B.: A review of activity trackers for senior citizens: research perspectives, commercial landscape and the role of the insurance industry. Sensors (Basel) 17(6) (2017). https://doi.org/10.3390/s17061277

Gough, D., Oliver, S., Thomas, J. (eds.): An Introduction to Systematic Reviews, 2nd edn. Sage, London (2017)

Arksey, H., O’Malley, L.: Scoping studies: towards a methodological framework. Int. J. Soc. Res. Methodol. 8(1), 19–32 (2005). https://doi.org/10.1080/1364557032000119616

Australian Bureau of Statistics: Health Service Usage and Health Related Actions, Australia, 2014–15: Private Health Insurance (2017). http://www.abs.gov.au/ausstats/abs@.nsf/Lookup/by%20Subject/4364.0.55.002~2014-15~Main%20Features~Private%20health%20insurance~5. Accessed 20 Feb 2018

Australian Bureau of Statistics: Australian Demographic Statistics, June 2017 (2017). http://www.abs.gov.au/AUSSTATS/abs@.nsf/mf/3101.0. Accessed 20 Feb 2018

Bundesministerium für Gesundheit: Gesetzliche Krankenversicherung - Mitglieder, mitversicherte Angehörige und Krankenstand (2018). https://www.bundesgesundheitsministerium.de/fileadmin/Dateien/3_Downloads/Statistiken/GKV/Mitglieder_Versicherte/KM1_Januar_2018.pdf. Accessed 20 Feb 2018

GKV-Spitzenverband: Anzahl der Krankenkassen im Zeitverlauf (2018). https://www.gkv-spitzenverband.de/media/grafiken/krankenkassen/Grafik_Krankenkassenanzahl_Konzentrationsprozess_300dpi_2018-01-03.jpg. Accessed 20 Feb 2018

Wikipedia: Private Krankenversicherung (2018). https://de.wikipedia.org/wiki/Private_Krankenversicherung. Accessed 20 Feb 2018

Henkel, M., Heck, T., Göretz, J.: Dataset of ‘Rewarding fitness tracking – the communication and promotion of health insurers’ bonus programs and the usage of self-tracking data’ (2018). https://doi.org/10.5281/zenodo.1183635

Lupton, D.: Beyond techno-utopia: critical approaches to digital health technologies. Societies 4(4), 706–711 (2014). https://doi.org/10.3390/soc4040706

Lupton, D.: Health promotion in the digital era: a critical commentary. Health Promot. Int. 30(1), 174–183 (2015). https://doi.org/10.1093/heapro/dau091

Lupton, D.: Self-tracking cultures. In: Robertson, T. (ed.) Designing Futures: The Future of Design. Proceedings of the 26th Australian Computer-Human Interaction Conference (OzCHI 2014), pp. 77–86. ACM, New York (2014). https://doi.org/10.1145/2686612.2686623

Lupton, D.: The Quantified Self. Polity Press, Cambridge, Malden (2016)

Rooksby, J., Rost, M., Morrison, A., et al.: Personal tracking as lived informatics. In: Proceedings of the SIGCHI Conference on Human Factors in Computing Systems, pp. 1163–1172. ACM, New York (2014). https://doi.org/10.1145/2556288.2557039

Asimakopoulos, S., Asimakopoulos, G., Spillers, F.: Motivation and user engagement in fitness tracking: heuristics for mobile healthcare wearables. Informatics 4(1), 5 (2017). https://doi.org/10.3390/informatics4010005

Donnachie, C., Wyke, S., Mutrie, N., et al.: ‘It’s like a personal motivator that you carried around wi’ you’: utilising self-determination theory to understand men’s experiences of using pedometers to increase physical activity in a weight management programme. Int. J. Behav. Nutr. Phys. Act. 14(1), 61 (2017). https://doi.org/10.1186/s12966-017-0505-z

Rowe-Roberts, D., Cercos, R., Mueller, F.: Preliminary results from a study of the impact of digital activity trackers on health risk status. Stud. Health Technol. Inf. 204, 143–148 (2014). https://doi.org/10.3233/978-1-61499-427-5-143

Lin, J.J., Mamykina, L., Lindtner, S., Delajoux, G., Strub, H.B.: Fish‘n’Steps: encouraging physical activity with an interactive computer game. In: Dourish, P., Friday, A. (eds.) UbiComp 2006. LNCS, vol. 4206, pp. 261–278. Springer, Heidelberg (2006). https://doi.org/10.1007/11853565_16

Brodin, N., Eurenius, E., Jensen, I., et al.: Coaching patients with early rheumatoid arthritis to healthy physical activity: a multicenter, randomized, controlled study. Arthritis Rheum. 59(3), 325–331 (2008). https://doi.org/10.1002/art.23327

Toscos, T., Faber, A., An, S., et al.: Chick clique. In: Extended Abstracts on Human Factors in Computing Systems (CHI06), pp. 1873–1878. ACM, New York (2006). https://doi.org/10.1145/1125451.1125805

Glance, D.G., Ooi, E., Berman, Y., et al.: Impact of a digital activity tracker-based workplace activity program on health and wellbeing. In: Kostkova, P., Grasso, F., Castillo, C. (eds.) Proceedings of the 2016 Digital Health Conference (DH 2016), pp. 37–41. ACM, New York (2016). https://doi.org/10.1145/2896338.2896345

Purpura, S., Schwanda, V., Williams, K., et al.: Fit4life. In: Proceedings of the SIGCHI Conference on Human Factors in Computing Systems, pp. 423–432. ACM, New York (2011). https://doi.org/10.1145/1978942.1979003

Rosenbaum, M.S., Ramírez, G.C., Edwards, K., et al.: The digitization of health care retailing. J. Res. Interact. Mark. 11(4), 432–446 (2017). https://doi.org/10.1108/jrim-07-2017-0058

Torre, I., Sanchez, O.R., Koceva, F., et al.: Supporting users to take informed decisions on privacy settings of personal devices. Pers. Ubiquit. Comput. 12(2), 1 (2017). https://doi.org/10.1007/s00779-017-1068-3

Tudor-Locke, C., Bassett, D.R.: How many steps/day are enough? Sports Med. 34(1), 1–8 (2004). https://doi.org/10.2165/00007256-200434010-00001

Australian Government: Private Health Insurance Act 2007 (2007). https://www.legislation.gov.au/Details/C2016C00911. Accessed 20 Feb 2018

IKK Südwest: Digitale Diät: Alle reden von Digital Health – und kaum jemand nutzt es (2017). https://www.ikk-suedwest.de/2017/06/digitale-diaet-alle-reden-von-digital-health-und-kaum-jemand-nutzt-es/. Accessed 20 Feb 2018

Zhang, J., Brackbill, D., Yang, S., et al.: Support or competition? How online social networks increase physical activity: a randomized controlled trial. Prev. Med. Rep. 4, 453–458 (2016). https://doi.org/10.1016/j.pmedr.2016.08.008

Lehto, M., Lehto, M.: Health information privacy of activity trackers. In: Proceedings of the European Conference on Cyber Warfare and Security (ECCWS), pp. 243–251 (2017). https://www.jyu.fi/it/fi/tutkimus/julkaisut/tekes-raportteja/health-information-privacy-of-activity-trackers.pdf. Accessed 20 Feb 2018

Lidynia, C., Brauner, P., Ziefle, M.: A step in the right direction – understanding privacy concerns and perceived sensitivity of fitness trackers. In: Ahram, T., Falcão, C. (eds.) AHFE 2017. AISC, vol. 608, pp. 42–53. Springer, Cham (2018). https://doi.org/10.1007/978-3-319-60639-2_5

Voas, J., Kshetri, N.: Human tagging. Computer 50(10), 78–85 (2017). https://doi.org/10.1109/mc.2017.3641646

Till, C.: Exercise as labour: quantified self and the transformation of exercise into labour. Societies 4(4), 446–462 (2014). https://doi.org/10.3390/soc4030446

Kaye, K.: FTC: Fitness Apps Can Help You Shed Calories – and Privacy (2014). http://adage.com/article/privacy-and-regulation/ftc-signals-focus-health-fitness-dataprivacy/293080/. Accessed 20 Feb 2018

Peppet, S.R.: Regulating the Internet of Things: first steps toward managing discrimination, privacy, security and consent. Tex. Law Rev. 78 p. (2014). https://ssrn.com/abstract=2409074. Accessed 20 Feb 2018

Kawamoto, K., Tanaka, T., Kuriyama, H.: Your activity tracker knows when you quit smoking. In: Proceedings of the 2014 ACM International Symposium on Wearable Computers (ISWC), pp. 107–110. ACM, New York (2014). https://doi.org/10.1145/2634317.2634327

Ertin, E., Stohs, N., Kumar, S., et al.: AutoSense: unobtrusively wearable sensor suite for inferring the onset, causality, and consequences of stress in the field. In: Proceedings of the 9th ACM Conference on Embedded Networked Sensor Systems (SenSys), pp. 274–287. ACM, New York (2011). https://doi.org/10.1145/2070942.2070970

Yan, T., Lu, Y., Zhang, N.: Privacy disclosure from wearable devices. In: Proceedings of the 2015 Workshop on Privacy-Aware Mobile Computing (PAMCO), pp. 13–18. ACM, New York (2015). https://doi.org/10.1145/2757302.2757306

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this paper

Cite this paper

Henkel, M., Heck, T., Göretz, J. (2018). Rewarding Fitness Tracking—The Communication and Promotion of Health Insurers’ Bonus Programs and the Use of Self-tracking Data. In: Meiselwitz, G. (eds) Social Computing and Social Media. Technologies and Analytics. SCSM 2018. Lecture Notes in Computer Science(), vol 10914. Springer, Cham. https://doi.org/10.1007/978-3-319-91485-5_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-91485-5_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-91484-8

Online ISBN: 978-3-319-91485-5

eBook Packages: Computer ScienceComputer Science (R0)